Accounting services

Accounting services for e-residents and startups. Fully online, fast, and focused on the benefit for your business. We understand the specifics of IT, crypto and international payments.

Accounting services: what’s included?

- Monthly accounting

- Payroll calculation and submission of the TSD declaration

- VAT accounting and filing of the KMD return

- OSS/IOSS returns

- Annual report

- Consultations

Who will be especially interested in our accounting services?

- Startups

- IT companies

- E-commerce

- Marketing agencies

- Freelancers

Frequently Asked Questions

Is the annual report included in the price?

Yes, the annual report is already included in the monthly service fee. You don’t need to pay extra for it.

How much do accounting services cost?

The monthly accounting service fee starts from 59 euros per month. You can read more about our pricing here.

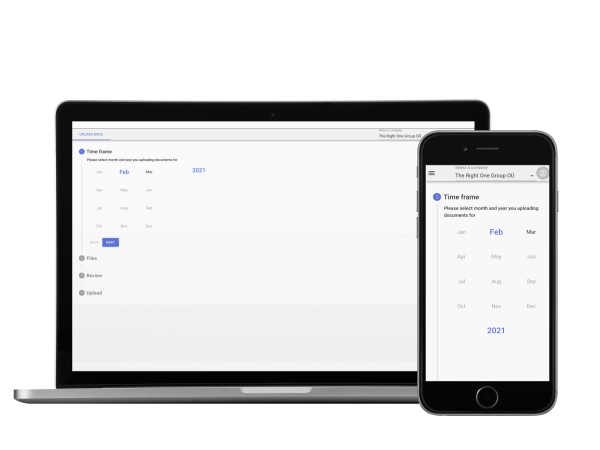

Do you have a client self-service portal?

Yes, all our clients have their own personal portal where they can generate sales invoices and upload expense documents.

Do you have templates for contracts and business trip reports?

Yes, all our clients have their own personal portal where they can download the most commonly used business document templates.

How does a monthly accounting service work?

- DAYS1–3

Bank statement upload

The accountant uploads the bank statement into the system and checks it for salary and dividend payments.

- DAYS4–10

Payroll calculation

If the company has employees or dividends were paid, the accountant runs payroll, calculates taxes, and files the TSD payroll return.

- DAYS8–10

Document reminder

The accountant requests any missing invoices, receipts, completion certificates, contracts, and other source documents.

- DAYS11–15

Processing invoices and bank transactions

The accountant processes source documents, matches them to bank transactions, and reviews them under our internal control procedures.

- DAYS16–20

VAT review and KMD filing

The chief accountant reviews the VAT calculation, confirms it, and files the KMD return.

- DAYS21–31

Month closed

The chief accountant posts closing entries. Reports are ready, everything is recorded — on to the next month.

How to enter into an accounting contract?

01 You send us a request via the contact form or through messengers.

02 After receiving the information, we will send you a price offer and a contract.

03 You send us the signed contract and the completed and signed “Know Your Client” form. Then we get to work!

Nola Accounting

To optimize and automate accounting services we use our own software.

The client does not need to send documents by email, all documents for the previous month are uploaded in the personal area of Nola Accounting.

You can also add a comment to the uploaded files for the accountant.

The application is constantly updated and more new features are available to the client.